The American Transportation Research Institute (ATRI) has once again released its annual "Operational Costs of Trucking" report, providing crucial insights into the financial landscape of the trucking industry. This comprehensive study, which began in 2008, has become an indispensable resource for industry professionals, offering a detailed analysis of operational costs and trends that shape the sector.

Now in its 16th year, the ATRI report continues to serve as a benchmark for trucking companies of all sizes, helping them navigate the complex economic environment in transportation. By examining a wide range of cost centers, from fuel, driver wages and beyond, the report offers a holistic view of the challenges and opportunities facing trucking operations today.

As we dive into the findings of the 2024 report below, we'll explore how the trucking industry has evolved over the past year and highlight the key points you need to know.

Key Takeaway: New Record-High Operational Costs

The most striking revelation from ATRI's 2024 report is that 2023 marked yet another record-breaking year for operational costs in the trucking industry. This milestone is particularly noteworthy as it represents the highest costs in the report's 16-year history, surpassing even the previous year's record.

Perhaps the most surprising aspect of this cost increase is that it occurred despite a significant decrease in fuel prices. This trend underscores the complex nature of the trucking industry's financial landscape, where multiple factors beyond fuel contribute to overall operational expenses.

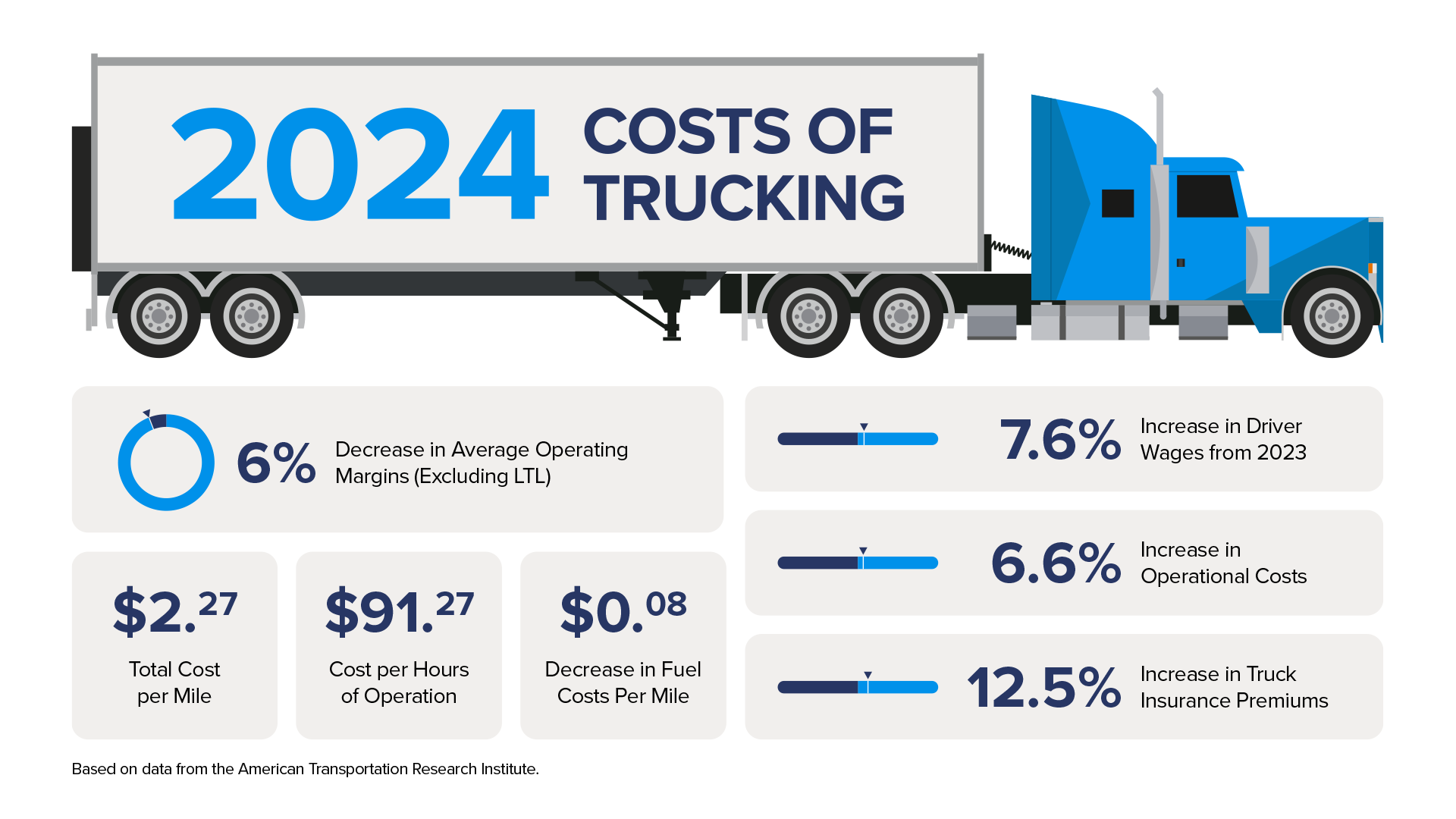

The total cost per mile for trucking operations reached an unprecedented $2.270 in 2023, marking a 0.8% increase from the previous year. While this increase might seem modest at first glance, it's important to consider the context: this rise occurred even as fuel costs, traditionally one of the largest expenses for trucking companies, saw a substantial decline by 8.8 cents per mile.

When we exclude fuel from the equation, the increase in operational costs becomes even more pronounced. Non-fuel costs rose by 6.6% compared to the previous year, from $1.610 per mile in 2022 to $1.716 per mile in 2023, highlighting the significant impact of other cost centers on overall expenses.

However, same as last year, it's not all doom and gloom for the trucking industry. Despite these challenges, there are also positive developments and opportunities emerging within the sector. As we continue into the report's findings, we'll explore both the hurdles and the bright spots that characterized the trucking industry in 2023.

Analysis of Operational Costs in the Trucking Industry

The ATRI report provides a comprehensive breakdown of the various factors contributing to the record-high operational costs in 2023. Let's examine these components –

Record-high cost per mile: As mentioned earlier, the cost per mile reached a new peak of $2.270 in 2023, representing a 0.8% increase from 2022. This figure captures all operational costs and serves as a key benchmark for the industry.

Record-high cost per hour: In addition to the cost per mile, the report also tracks cost per hour of operation. In 2023, this figure reached a new high of $91.27 per hour.

Several other cost centers saw increases, contributing to the overall rise in operational expenses:

- Repair and maintenance costs continued to climb, reflecting the increasing complexity of modern trucks and the ongoing challenges in the supply chain for parts.

- Truck and trailer payments increased, likely due to higher interest rates and the rising costs of new equipment.

- Auto liability insurance premiums saw another year of growth, continuing a long-term trend of rising insurance costs in the industry.

- Tire expenses also increased, affected by both rising material costs and potential supply chain issues.

- Driver wages, which we'll explore in more detail in the next section, continued their upward trajectory as companies compete for skilled drivers in a tight labor market.

These increases across multiple cost centers demonstrate the complex challenges facing trucking operations. While fuel costs provided some relief, the rises in other areas more than offset these savings, leading to the overall increase in operational costs.

Driver Compensation and Turnover

The trucking industry continues to grapple with the dual challenges of driver compensation and turnover, and the 2024 ATRI report provides valuable insights into these interconnected issues.

In 2023, driver wages saw a significant increase of 7.6%. This substantial rise reflects the ongoing efforts of trucking companies to attract and retain skilled drivers in a competitive labor market. The increase also underscores the critical role that drivers play in the industry and the growing recognition of their value.

Despite the increases in compensation, the industry saw mixed results in terms of driver turnover.

For truckload fleets, turnover rates worsened in 2023. This surprising trend, occurring alongside increased wages and benefits, suggests that factors beyond compensation are influencing driver retention.

On a more positive note, Less-Than-Truckload (LTL) carriers experienced a slight improvement in turnover rates. This difference between truckload and LTL sectors could be attributed to variations in working conditions, routes, or other job-related factors.

In fact, the report identifies a key factor affecting driver turnover:

Annual mileage per truck plays a role in driver satisfaction and turnover. Changes in route efficiency, delivery patterns, or overall freight demand can impact the miles driven and, consequently, driver earnings and job satisfaction.

These findings highlight the complex nature of the driver retention challenge. While competitive compensation is crucial, it's clear that other factors such as work-life balance and job satisfaction.

As the industry continues to evolve, addressing these driver-related challenges will remain crucial for operational stability and long-term success. In the next section, we'll explore how these factors, along with others, are impacting industry capacity and efficiency.

Operational Costs for Small Fleets vs. Large Fleets

The trucking industry is diverse, with operations ranging from single-truck owner-operators to large fleets with thousands of vehicles. The 2024 ATRI report provides valuable insights into how different-sized fleets are faring in the current economic environment including a few we pulled out below:

- Small fleets demonstrated agility in responding to market changes. For example, truckload carriers with fewer than 5 trucks had the lowest percentage of deadhead miles at just 10% of their total mileage.

- Smaller fleets, particularly in the truckload sector, felt significant economic pressure. Truckload fleets with fewer than 26 trucks saw a slight dip in driver wages compared to 2022, suggesting they were more affected by low freight rates.

- Specialized fleets’ driver pay showed less variation, increasing across fleet sizes.

- Larger fleets showed an advantage in implementing technologies like speed governors. 97% of fleets with more than 100 trucks used governors, compared to only 64% of fleets with 100 or fewer trucks.

This analysis highlights the diverse needs and challenges faced by different-sized operations within the trucking sector, underscoring the importance of tailored strategies and policies for the industry's various segments and providing crucial context for understanding the overall health of the trucking industry.

How RTS Can Help Improve Your Operational Efficiency

While we have pulled out various stats from the 2024 ARTI operational costs report, the real headline remains: the total cost per mile for trucking operations reached an unprecedented $2.270 in 2023, a new record for the industry. This record number highlights how it’s more important than ever to improve your operational efficiencies, and RTS can help you do that in three distinct ways.

First, through fuel. As you saw above, fuel savings helped offset the rise in other operational costs, and RTS can help you maximize your fuel savings through our fuel card program. It’s not just about saving a few pennies at the pump on a single trip. Usage of RTS fuel cards over a month, three months, a year, can create impactful savings in the long run. Don’t wait until next year’s report to recognize the crucial part fuel savings play in overall operational efficiency.

Second, through factoring. How does factoring help? The simple answer is cash flow. Margins are getting tighter all the time, and it can be difficult to run your business in that environment while potentially waiting for payment on your open invoices. Factoring has become a key part of operations for many businesses that hadn’t previously looked into this option.

Lastly, our ecosystem. There are so many needs of a trucking business that go beyond just fuel and factoring, and we’ve seen them all. RTS has been in the business for decades, knows the ins and outs of the industry, and has solutions ready for whatever needs may arise. Our knowledge and integration lead to greater operational efficiencies for our customers.

Reach out to find out more about how we can assist with your current needs and help get your operations running right.